Why: Investing can seem like an extremely daunting and risky task from an outsiders perspective. To many it appears to be something that either they can’t afford to do or don’t have the knowledge to navigate. This unfortunate truth has lead to many people ignoring it all together when investing nowadays is something that can’t be ignored, ESPECIALLY by the younger generations. Why? Well the youth have a lot more to consider when it comes to their future and retirement, there is a large chance that for many of us when it comes time to retire social security will be long gone. Furthermore, interest rates are extremely low right now meaning that simply leaving your money in a high interest savings account is no longer sufficient. So how can we encourage the youth to begin investing when so many say they don’t know how? Well, let’s go through a simple beginners guide on how to invest. I will walk you through the steps to set up 2 different types of brokerage accounts, how to navigate them, and give you some information on making your first trade. The only assumption I will make about your knowledge is that you know what a stock is, if not I will be making another article on that soon.

Choosing a brokerage account: To begin your journey in investing you first need to choose a company through which you will invest. These companies are called Brokerage Firms or put into simple terms, you give them your money and in return they give you stocks. Through a brokerage firm you create what’s a called a Brokerage Account, this process is super similar to opening a savings account with your bank, the key difference being that you can buy and sell stocks straight from a brokerage account, while you cannot with a savings or checking account. There are hundreds if not thousands of brokerage firms across the world making it difficult for some to make a choice on where to open their brokerage account. For this guide we will focus in on 2 of the most popular brokerage accounts currently used in the United States, that being Robinhood and Acorns. These two companies have essentially made it their mission to make investing as easy and painless as possible, taking all the hard work out of buying and selling stocks and sparking a passion for investing within millions of people. I use both of these companies myself and can say that they do a great job of simplifying what once seemed too complicated. The key difference between these two accounts is that Acorns automates the whole investing process, while Robinhood does not. In other words, with Acorns all you have to do is decide how aggressive or defensive you would like your investments to be, deposit money, and let Acorns do the rest for you. While on the other hand, Robinhood allows you to search a massive catalog of stocks, ETF’s, Index funds, and cryptocurrencies (Will get into what each of those are later.) and leaves it to you to choose exactly where you want to invest your money. Acorns requires much less time and research spent but also limits your options and leaves less room for personalization, Robinhood allows you to diversify much further and personalize your portfolio as you like, but in most cases requires some market research and a bit more effort, got it? So at this point, if you’re going to follow along with the guide you need to think to yourself, do I want to keep this easy and effortless, have it done for me? Or do I want to dive deeper and learn more about where I’m putting my money and why? If your answer is that you want to keep it plain and simple, Acorns is going to be the better option. If your answer is that you want to dive deeper, Robinhood is definitely going to be a better choice. To sign up for Robinhood here to receive a free stock work up to $500 click here. To join Acorns and receive a $5 sign up bonus click here.

Signing up: So now that you’ve figured out which account is best for you, let’s see what you’re going to need to sign up. The process to set up a brokerage account is going to be pretty similar across the board, with some requiring a few more supporting documents than others. The sign up process can be broken down into 4 bits, personal information, supporting documents, bank information, and a short wait for approval, not necessarily always in that order. Both accounts featured in this guide (and all other brokerage accounts) will have you fill out a form with personal information such as name, address, email, and phone number. Next they will need you to provide supporting documents, this will include ID of some form (drivers license or passport) and likely a social security card to verify your social security number. You can simply submit pictures of these items and within a few days they will respond with an approval or denial. The reasons they need these documents are identical to those of a bank, they need to know who you are and how old you are. To open a brokerage account you need to be 18 years of age, now before you stop reading because you aren’t 18 yet, don’t forget to ask a parent if they can make an account that you can use. I personally used a Robinhood account that I had my parent make to start my investing career and if you feel comfortable asking do not hesitate to see if you can do the same. Back to creating your account, the final thing you will need to connect is your bank account so that you can initiate transfers back and fourth between your savings account and your brokerage account. Once all of this is complete you will encounter a short wait time for approval of your account and that’s it, you’ve now created your first brokerage account. From here on out navigating each app becomes a little different so I will start with Robinhood then move to Acorns.

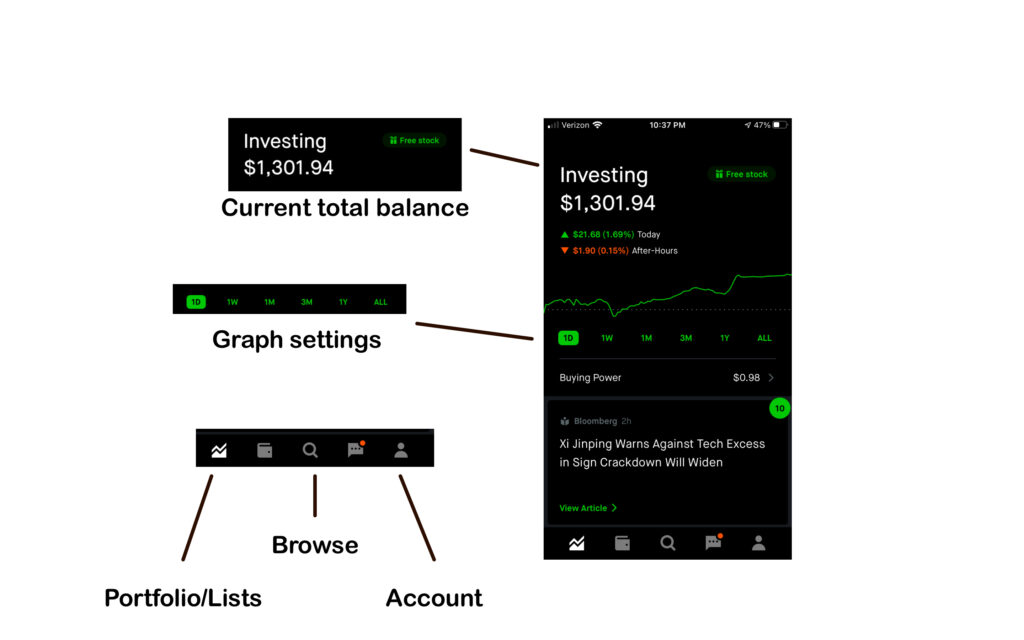

Basic Robinhood app navigation: Navigating the Robinhood app is relatively simple for beginners as you only have to pay attention to a handful of buttons to get going, the rest we can dive into later. So let’s begin with breaking down the home page, the page you see in the picture above. The home page will consist of a few elements, the main one at the top being your current total balance and a graph showing how your investments have done that day. To change the graph so you can see longer term than a day, you have some graph settings as pointed out in the diagram. If you scroll down on this page you will be presented with a news article or app reminder, and below that will be the stocks you currently own as well as the stocks you have saved. I recommend clicking on the box that contains the stocks price and when presented with a menu, select to display price change in percentage, this is by far the easiest way to view the change in price. Thats really all you need to know about the home page, let’s move onto the browse page so you can start adding some shares you want to keep an eye on to your home page. To get to the browse page you simply click on the small magnifying glass icon in the toolbar at the bottom, you will be presented with a page where you will be able to search for stocks, index funds, ETF’s and cryptocurrencies; the browse page is also an awesome resource for news pertaining to the stock market, I recommend checking this page anytime you are wondering why the market is up or down. To search for a stock simply click the search bar and either type in the name of a company you know or the tag for a certain stock you’ve heard of. Stock names are often shortened into 3 or 4 letter tags due to companies having long names, for example Apple is, AAPL. If you can’t find a company by entering its name you should first check google to see if the company is publicly traded, then look up it’s tag and enter that instead. Finally we will look at the account page. The account page is pretty important as its where you will go to withdraw and deposit money, close your account, receive tax documents, or change settings. The account page is easily found by clicking the far right button in the tool bar at the bottom. To deposit or withdraw money, simply hit transfers, select your transfer type, enter the amount, and you’re off. The whole process with Robinhood is pretty simple though they do give you the option to dig deeper, but what I have just shown you should be enough to get you started.

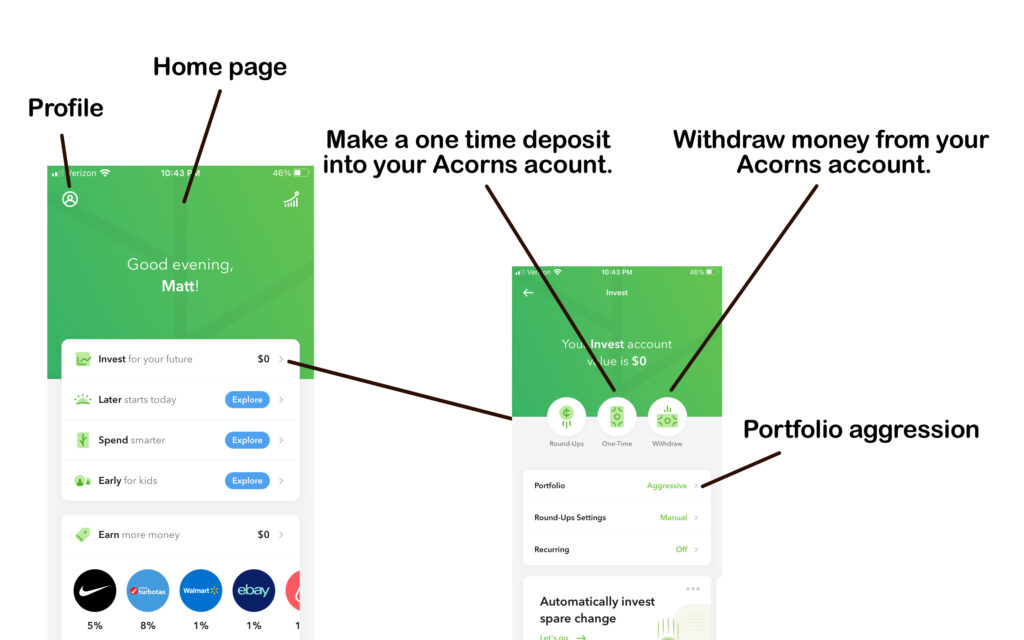

Basic Acorns app navigation: Getting started with Acorns is going to be even easier than it is to get started with Robinhood because Acorns will do the selecting and investing for you. The only thing you really need to know about navigating the app is how to deposit and withdraw money, along with knowing where to go to change the aggressiveness of your portfolio. To begin, you will always start at the home page (labeled on diagram), from there if you would like to deposit or withdraw money you can simply hit the button labeled “Invest for your future,” from there you will see an option called “one time” which is a one time deposit from your bank into your account. The next one is a withdrawal, you can assume what that might be. Directly below the deposit and withdraw buttons you will find a button labeled “Portfolio,” this is where you will be able to change the aggression of your portfolio. That pretty much sums it up for a basic overview of using Acorns. Once you have deposit some money and selected how aggressive you would like your portfolio to be, Acorns does the rest! Now lets look at your investment options so you can figure out what’s best for you.

Choosing your first Robinhood investment: You’re almost there! Now we will take a quick look at some of the different ways you can use your money in Robinhood. There are countless ways to invest so I will just talk about 3 options that I have personally dabbled with. The first is going to be cryptocurrency, a digital currency different from a stock in that there is no company for you to receive a slice of, rather you are truly putting your money into digital gold coins and watching to see whether their value falls or rises. There is a massive and confusing amount of information to unpack when it comes to cryptocurrencies but put plain and simple, they are extremely volatile (at high risk of large fluctuations) and lack physical backing. The next is going to be buying individual stocks, there are millions of different individual stocks you can purchase and making the decision on which really falls down to research, prediction, and volatility. I know that isn’t hugely inspiring but I as a fellow investor cannot tell you to buy one or the other for the right answer is very dependent on the person. Finally we’ll talk about index funds and ETF’s, which allow you to purchase many small slices of a set of companies rather than investing solely into one company. A prime example of this would be the S&P 500, which tracks the top 500 companies in the United States, by purchasing one share of the S&P you are purchasing one share of each of the top 500 companies, that is an index fund. For those of us who can’t afford to buy one share of each of the top 500 companies, there are wonderful things called ETF’s, which are essentially a slice of an Index fund. Many of these ETF’s are like baby index funds, tracking the top 500 or all companies in the United States and allow people to invest into a significantly less volatile share and a lower cost. With those in mind, you can now do a little but of your own research and figure out where you want to put your money.

Purchase shares: Once you have figured out what shares you want to purchase, you simply have to search up to company or stock name, hit the buy button, select the amount you would like to purchase and just like that you’re off. From here on out the name of the game is continuing to add more omen into your portfolio and purchasing more shares, building your wealth for the future. If you want to automate this process Acorns allows you to do so by setting up what are called recurring investments, these recurring investments will withdraw a specified amount of money from your bank account each week, this allows for your portfolio to grow without you ever really needing to do anything.

Let your money grow: Well, we’ve come to the end of this guide. You did it! You took your first steps in building investing for your future and I bet it was surprisingly easy. From here I have 2 tips before setting you off on your way, the first is to try not to constantly check the app. It may be very tempting to constantly look at how your money is doing, but I promise this is not necessary as it leads to you panicking anytime there is a bad day; try to check it maybe once a week and when the dips come do not sell, either wait them out or go with my second tip which is to buy the dips. When the market dips is the best time for you to buy, buy low and sell high as they say, rather than considering selling out when the market dips instead try considering purchasing more. In the last 70 years throughout many crashes, the market has stayed on an upward trend and those that didn’t panic sell when the market fell came on out on top, furthermore, those who bought more every time the market collapsed even further ahead. Well off you go, go make some money and invest in your future. If you ever need to refer back to this guide, DO IT! It’s here to help and there will be more similar guides on the way soon. I will have links to sign up for Acorns and Robinhood scattered throughout the article. Thank you and good luck in your investing.

Sign up for Robinhood and receive a FREE stock worth up to $500 here.

Join for Acorns and get a $5 sign up bonus here.

Leave a Reply